Description

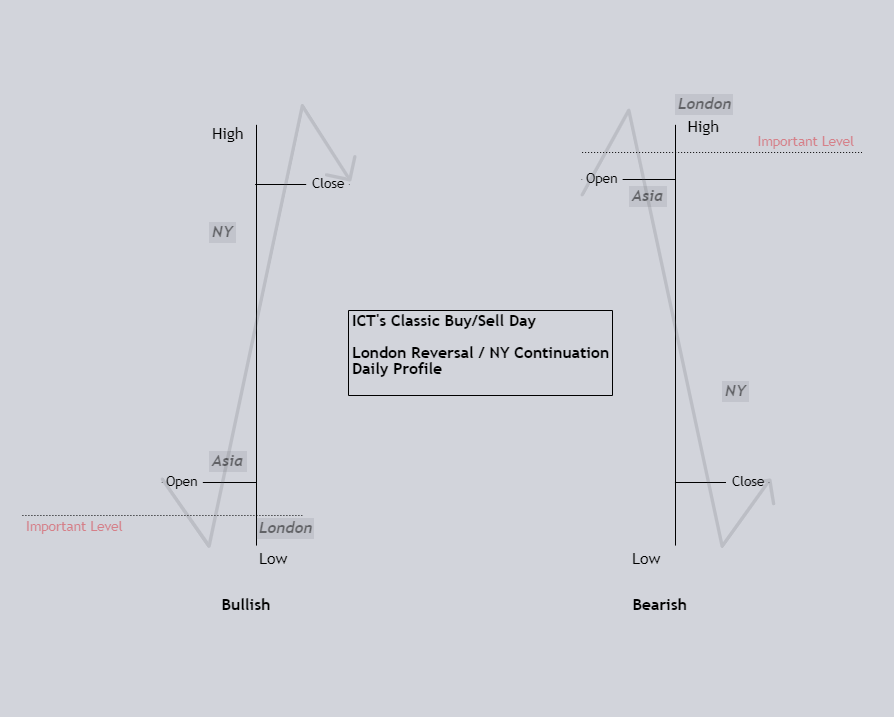

The London Reversal is one of the primary daily profiles for expansion days. It is essentially ICT’s classic buy/sell day. However, in this article we refer to AMTrades’ Market Profiling Guide as the primary source of explanation while supplementing with extra notes from TTrades’ videos.

You can find a link to download AM’s Market Profiling Guide in the resources section at the bottom of this page as well as links to TTrades’ and others content I’ve found useful while studying this daily profile.

⚠️ Reminder

Daily profiles should always be framed within the context of the weekly profile’s narrative!

The London Reversal profile is a scenario in which we can anticipate the daily candle to expand in the direction of the higher time frame(HTF) draw on liquidity(DOL) during the New York session. It’s essentially ICT’s classic expansion day (or trend day), where the Judas Swing is formed during London to create the low/high of day prior to the NY AM session.

You can also look at it as an AMD Power of Three where the Asia session accumulates, London manipulates one side of Asia’s range away from the draw on liquidity, leaving NY to expand towards the draw.

Framework

The framework is relatively straight forword:

London trades, engaging a 1hr or greater time frames PD array above/below the midnight opening price between the hours of 02:00 – 05:00 am before reversing and causing a change in the state of delivery(CISD) and setting up the New York session to expand in the direction of the HTF draw.

- London engages 1hr or above PDA

- CISD forms on the m15 or above time frame (m30 or 1hr is better)

Entry Range

- Retracements towards London’s reversal becomes a buying/selling opportunity during the New York session

- m15-1hr internal PD arrays

- (optional): use fib levels

Note: The majority of the NY expansion occurs between 7:00-10:00 am EST for forex markets and 8:30 – 12:00 for indexes.

Confirming the Change in State of Delivery (CISD)

- London Engaged 1hr or greater PDA

- Example: m15 candle close over breaker

- Can observe on m15 but a 30m or 1hr CISD is preferred.

Once this CISD occurs, bullish/bearish order flow can begin.

Days of Week To Anticipate London Reversals

Classic Expansion Weekly Profile:

- Tues

- Wed

- Thurs

Midweek Reversal Weekly Profile:

- Wed

- Thurs

- Fri

Consolidation Reversal Weekly Profile:

- Thur

- Fri

Invalidation/Negative Conditions

- London Expansion: London expands, exhausting most of the daily range prior to the New York AM session.

- No PDA engaged: London fails to engage a 1hr or greater point of interest

- NY PM News: High-Impact news release during NY PM session such as

- FOMC Statement (2:00 pm EST)

- FOMC Press Conference (2:30 EST)

Projecting the Daily Range

We can project a likely range a London Reversal daily profile by measuring the manipulation leg..3

Does London have to sweep Asia session liquidity to fit the profile?

Not necessarily. The important thing is determining what did London do. If London reversed, then the profile can is valid. But just because the profile is valid doesn’t mean it’s not in conflict with the HTF narrative, we need to check off all the boxes!

Resources

Below is a link to AMTrades’ market profiling guide as well as some extra resources/explanations to help you study.