Rejections blocks are one of ICT’s Premium/Discount Array (PDA) element’s that tend to form around old highs/lows. As the name suggests rejection blocks are a signature in price indicative of a potential reversal forming. Learning to spot this particular PDA can help us learn to anticipate

What is a Rejection Block?

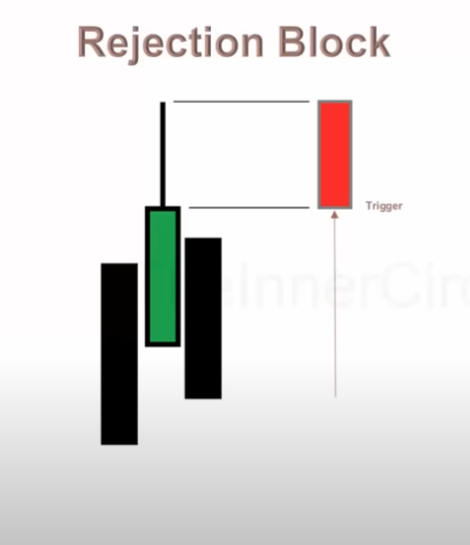

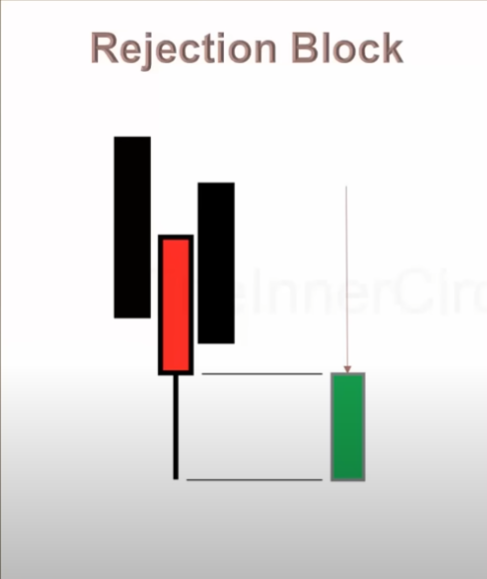

- What is it? A rejection block is one of ICT’s PDA concepts. It forms when a candle creates a long wick (or wicks) that sweeps liquidity before reversing.

- Wicks highlight the idea of this pattern forming.

- Wicks are just drawing our attention to a potential rejection block

- Can be in the form of one or more wicks, it is not limited to just one candle

- The wicks should be running out some form of liquidity before reversing

- We can treat these just like an order block

- has to be a swing point with a wick or wicks

- Ideal setup: In major to Intermediate Term Trends

- Additional notes:

- Price does not necessarily need to make a higher high or lower low, the turtle soup can come in the form of a failure swing (as opposed to a breaker swing). We need to pay attention to the candle bodies [need to point this out in an image likely. Possible place to link to both swing points page and possibly a dedicate page on OHLC/OLHC?]

- When studying Rejection blocks, pay close attention to the bodies of the candles. It’s really important to understand where the open, high, low, and close is.

- Follow every swing high and low

- chart the open, high, low, and close

- pay extra attention to the opens and closes to figure out what distribution and accumulation takes place at these turning points

- Rejection blocks are essentially a hammer or shooter reversal candle that form at major highs and lows on the chart. (Note: It can be more than 1 candle that forms the high/low that’s being run)

- on a lower time frame, for example in a bearish context, we look for a liquidity sweep to occur, taking out a old high and failing to displace above it, reversing back into the previous range, likely in continuation of the HTF trend

- A rejection block is where price trades into a key level and “rejects” it, failing to displace outside of the range. In other words, it’s basically a false break above/below an old high. Or again in other words, a false or failed breakout.

- Once the candle forms, there should be a subsequent and significant price swing lower or higher

- These failed breakouts/breakdowns are often refered to as “Turtle Soup” or another way to look at it is its a run on buy or sell stops.

- It’s important to understand liquidity. The idea behind “turtle soups” is multifaceted: 1) it stops out anyone who’s trailed their stop loss, taking them out of their position and 2) it induces breakout traders into going long or short ultimately leading to a failed trade for them. 3) it allows smart money to offload their positions to willing participants (breakout traders) or perhaps reluctantly willing in the form of stop losses. This run triggers their stops and forces the position to close. It’s important to understand how stops work and how most traders (all the books really) teach how to trailer stops. smart money who bought at the lows is seeking to offload, or pair their orders, with short sellers buy-stops at the highs because they are forced to buy to close, visa versa where longs are forced to sell to close.

- While some traders focus on “catching the Turtle Soup” or “souping” a high/low, it’s important to note that catching reversals is difficult to anticipate. It’s generally much easier to wait to trade the continuation after the sweep and reversal has been confirmed.

- its probably one of the harder strategies to learn

- it does offer excellent risk to reward and can be a very powerful strategy when done properly. Generally when price rejects these levels we see some pretty aggressive moves proceeding them.

[dedicated section on inducement? explain run run on stops or “stop hunts”, breakout traders, lead into turtle soup traders section perhaps? I do/did plan to have a page to discuss liquidity in general, can either move some of the explination about stops etc there to keep this focused more on the idea of rejection blocks while only briefly mentioning it (internal link opportunity) have not written that page yet either…might be an opportunity to start on it i guess]

What is “Turtle Soup”?

We could probably dedicate a whole page to the topic but simply put…

[Explain What is Turtle Soup and where did the name come from?]

Turtle soup is a reference to the Turtle Traders…[brief section keep small but give a little history on the turtle traders]

Why I don’t recommend it for especially newer traders? Couple reasons…

One might argue that traders who “soup” highs/lows perhaps struggle with greed/fomo because they want the crazy risk:reward (RR) or are afraid of missing the move. They’ve been lulled into thinking they have to catch the high/low because it would offer the ultimate risk:reward. When traders successfully do it, they tout these big 1:10RR or 1:30RR trades. However, what they fail to also say is they tried 20 plus times to catch the falling knife as price was tearing through their stops on the way down and they won’t show the massive hole in their other hand as they got sliced and diced trying to “soup” the lows for that social media post. Can you do it? Absolutely, sure, but I would argue it’s one of the more difficult ones, despite the “cool name” and massive risk:reward ratio’s the strategy is capable of when done successfully. Trying to soup levels has lead to many blown accounts.

Resources

ICT Mentorship Core Content – Month 04 – ICT Rejection Block