If you’re anything like me, learning ICT’s Order Blocks (OBs) has been a bit confusing. My first introduction to the concept was in Michael J. Huddleston’s (ICT) 2022 YouTube Mentorship series, where it was briefly explained. After watching price repeatedly slice right through what I believed was an Order Block, I began searching for a clearer definition, often from other educators, but I only found even more confusion—everyone seemed to define Order Blocks differently and claimed they use them all the time. So what gives? Why don’t they seem to work for me?

It wasn’t until I came across TTrades’ Order Block videos and spent a considerable amount of time studying his material on the charts, that the concept began to click for me. His mechanical approach and definition of OBs has helped connect the dots that finally made OBs work for me with some level of success. After reading some comments on his videos, it’s obvious I wasn’t alone in feeling that way.

[Links to resources on OB’s can be found below. Study them closely!]

This article serves as a resource for my deep dive into Order Blocks. It is an attempt to solidify my understanding of what an Order Block is, its significance within ICT’s trading concepts, how to properly identify and validate OBs on the charts, ways to use them in my trading, and most importantly, when they are likely to be disrespected so as to ignore them.

What is an Order Block?

Order Blocks are a foundational element within ICT’s Premium/Discount Array (PDA) Matrix. They represent specific price levels where significant institutional orders have caused a Change in the State of Delivery (CISD), causing a shift in the delivery of price. These levels often act as sensitive points of support or resistance when price returns to them and are a crucial concept to understand (in my opinion) for any ICT trader wanting to tape read order flow effectively.

Definition of ICT’s Order Block – Simplified by TTrades

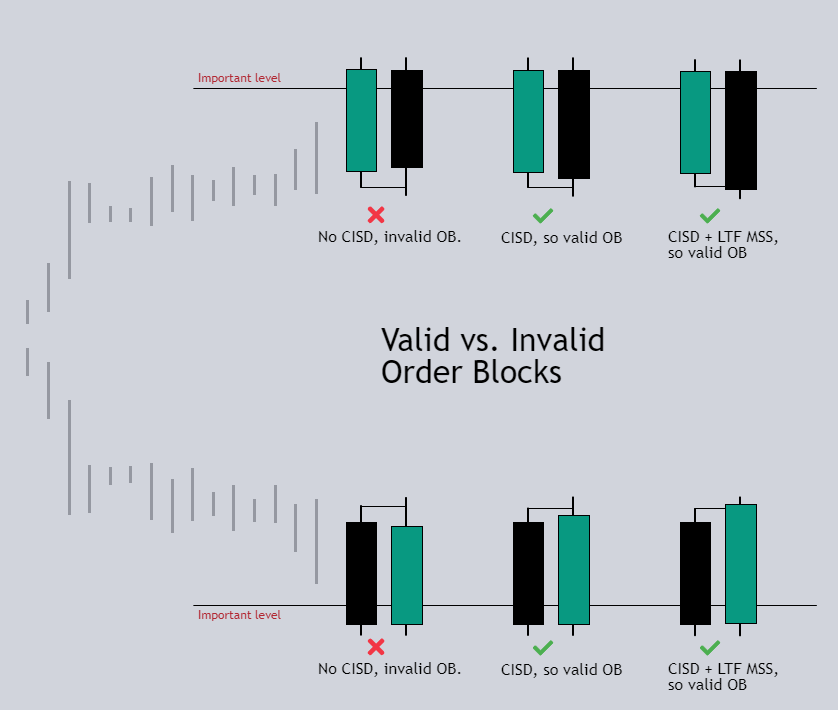

An Order Block (OB) is a specific signature in price that indicates a Change in the State of Delivery (CISD). A valid OB can be identified when we have a sweep of liquidity into an important level before displacing and closing beyond the opening price of the candle (or series of candles) that swept liquidity into the point of interest.

- For a Bullish Order Block: The subsequent candle(s) must close above the opening price of the down-close (or series of) candle(s).

- For a Bearish Order Block: The subsequent candle(s) must close below the opening price of the up-close (or series of) candle(s).

You can view ICT’s actual definition of an orderblock in month 4 of his Core Content Mentorship here.

What is a Change in the State of Delivery (CISD)

Order Blocks are intimately connected to what ICT refers to as a Change in the State of Delivery (CISD). A CISD occurs when the market transitions from one state to another, such as from bullish to bearish. This shift in price delivery is confirmed when price closes beyond the opening price of a specific candle or series of candles that make up an order block.

For example, in a bearish scenario, if we get a close below the opening price of an up-close candle (or series of candles) that reached into an important level, a CISD has occurred. This signals a potential shift in current market sentiment, indicating price may now move in the opposing direction, reflecting a change to order flow. This change can be the result of a temporary pullback in the HTF trend or indicative of a full reversal, depending on the broader market context.

As always, we need to be aware of the overarching narrative in the market. Where did price come from, and where is it likely heading?

Identifying Valid Order Blocks

An Order Block is validated when a subsequent candle closes beyond the opening price of the candle, or series of candles, that swept liquidity into an important level. This close confirms the CISD and forms the OB.

What Invalidates an Order Block?

How to Identify an Order Block?

When price displaces through the opening price of a candle that opposes order flow and closes beyond it, this confirms the change in the state of delivery.

- Near a support level (HTF POI)

- Mark the opening price of the candle

- Should see a fair value gap form when price trades back through the opening price of the candle(s) that reach into the important level.

High Probability vs. Low Probability Order Blocks

High probability order blocks are big full bodied candles that swept liquidity.

Low probability order blocks have smaller bodies and thus longer wicks.

- Generally only use low probability order blocks when price is trending and it is the only opposing candle in the range

- For low probability OB’s we can use the wick to the open for a point of interest for entry

How to use Order Blocks?

- Mean Threshold (MT): We want to see the MT (50%) of an OB respected to support trade idea. Mark out premium and discount to help determine when it makes sense to use the MT vs the Opening Price of the OB

- Opening Price: The opening price of an OB should be sensitive, meaning price should react strongly off of it.

- Identifying Trend: OB’s can help us determine trend. So long as an OB is not invalidated

- Entry Techniques

- Stop Loss Placement

Insightful Tweets from TTrades on OB’s

Below is a compilation of tweets from @TTrades_edu on twitter I’ve found extremely helpful in my own studies on Order Blocks. If you’re interested in diving deeper into order blocks, I suggest digging through his posts.

Do Order Blocks have to sweep liquidity?

No, not necessarily. It is a preference really. The advantages to an OB that sweeps liquidity first is that it creates a protected level which can be used as an invalidation of a trade idea.

Why do Order Blocks work?

Order Blocks work because they signal significant institutional activity that influences price movement and shifts order flow. Once validated, an Order Block indicates a change in the state of delivery, suggesting a potential short-term shift in market direction, even if the higher time frame trend remains intact.

For example, when a bearish Order Block is formed, traders who entered long positions during the up-close candle’s formation are likely now in drawdown. This pressure forces them to either weather the drawdown or exit their position thus contributing to further selling and reinforcing the OB’s effectiveness.

Further Resources on Order Blocks

From ICT

Below is compilation of some videos where ICT has spoken about OBs. Some of the links are timestamped to take you directly to where he discusses them.

- ICT Mentorship Core Content – Month 04 – Orderblocks

- ICT Mentorship 2023 – Proper Learning & The Importance Of Journaling [1:05:19]

- ICT Tuesday June 13, 2023 \ CPI & Price Action Lecture [50:05]

- 2022 ICT Mentorship Episode 12 [39:32]